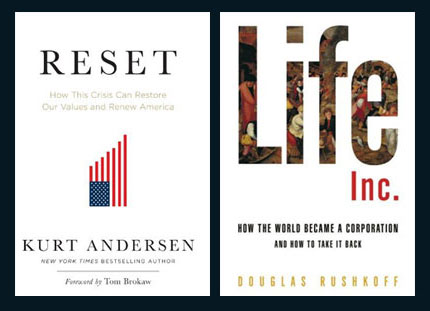

Long before the global economy seized up, Kurt Andersen and Douglas Rushkoff were contemplating the links between society and capital—which makes their views on the recent recession timely, if notably different from one another's. In June, Rushkoff, the media critic and documentary filmmaker, published Life Inc.: How the World Became a Corporation and How to Take It Back. In this book, he interprets the recession as the outcome of a centuries-old ethos prizing speculation over value and profit over human connection. Andersen, essayist, novelist, and host of public radio's Studio 360 arts program, for his part, has just come out with Reset: How This Crisis Can Restore Our Values and Renew America. As the title suggests, it’s a study in optimism.

Change Observer’s Julie Lasky invited both men to discuss how we landed in this stew and what the recession portends. The conversation took place via email July 6–10, 2009.

Julie Lasky

Let me start by asking each of you about the impulses behind your projects. Doug, you’ve famously recounted the story of being mugged in Park Slope, Brooklyn, and bringing down the wrath of your neighbors for reporting the incident on a community website. In Life Inc., you describe decamping to the suburbs not to escape crime but to get away from people whose worry over property values trumped their concern about the inequities and tensions bred by urban gentrification. You attribute such attitudes to a corporate mentality that has evolved over centuries. Was it a simple step from the Park Slope mugging to this book, which I think can be fairly described as an anti-corporate diatribe, or are there more complicated roots? And if so, what are they?

Douglas Rushkoff

I began the book about a year before the mugging incident. Originally, my purpose was to look at the economy from the perspective of a media theorist. And in doing so, I became amazed by a few things:

1. People seemed incapable of recognizing that the money they were using was just one kind of money, with very particular biases. They were relating to Federal Reserve notes as if it were the only kind of money that ever existed or could ever exist. And they seemed completely unaware of how money loaned into existence by a central bank demands that businesses and the economy grow at the rate of interest rather than some connection to supply and demand.

2. Debt had become our nation's biggest product — and it doesn't actually create any value. It's ultimately an extractive force. I always understood how our economy could support a few people who do nothing but speculate on the economy — but I was having trouble understanding how the economy could support more speculators than value creators.

3. It seemed that very few American businesses actually did anything any more. Many companies were calling me to help them communicate their brand values more "transparently" to consumers — but transparency would mean opening the companies to observation and participation. This is plainly impossible for companies that don't actually do anything. I was amazed by the dog food scandal, in which people called their dog food companies to find out if their manufacturing had been outsourced to the plant in China responsible for the poisoning. American dog food companies could not answer their customers' queries, because they just didn't know. They had outsourced their outsourcing to yet another Chinese company. They didn't even do their own outsourcing.

4. And finally, like any media theorist, I was intrigued by the fact that most people accepted the rules of our particular market as the market — as a pre-existing condition of nature, rather than a very particular marketplace developed at a particular moment in time by particular people, for reasons that may or may not be relevant or applicable to our current economic priorities.

These factors combine to make a simple deconstruction of what happened and how it happened appear to you, Julie, like an anti-corporate diatribe. I'd argue it's because these institutions seem so necessary, so much a part of nature, that merely considering their origins as human inventions is almost sacrilegious. I got really interested in just that phenomenon. Sure, people bemoan the second Starbucks opening on the same block, but that's just a question of aesthetics, for the most part. At least, as they understand it. So complaining about it is pointless venting.

Understanding it—the economics of what it means to work for a Starbucks instead of owning a local coffee shop—is very different. So I would hope to distinguish my work from, say, the movie The Corporation or Ben Barber's book Consumed, which either personify the corporation or (in Barber's case) complain about the "puerile" culture that results.

All I wanted to do was show how we got here, how this way of life was sold to us in the 20th century by the very same folks who originally saw fascism as a great idea, and why I believed it to be economically unsustainable. Remember, now, every chief economist of every major investment firm or bank I spoke with insisted that the economy was sound, and that it was bound for increasing expansion. And none of them knew what I was talking about when I asked them about the biases of the money we use. "There were other kinds of money?" they all asked, amazed.

So it was in this context that I got mugged, posted what had happened to a mailing list and got attacked for announcing the street on which it happened; people thought it would hurt the asset value of their real estate. That gave me an opportunity to realize how deeply these values had been internalized. People cared more for the short-term asset value of their houses as property than the long-term value of their houses as homes as part of a neighborhood. This simply made it even more important for me to look at the way we had become corporatized ourselves. It's not about blaming Wal-Mart. It's about looking at the way we think and act. So rather than railing against corporations (I explain why it must not be done three or four times in the book), I insist we simply understand the process through which we adopted the underlying logic of corporatism as natural law rather than a construction.

Then the crash happened — when I was about halfway through the book — and I was freed to go a bit further, and look at the next stage: the crisis is actually an opportunity. It helped everyone see this unsustainable (or even anti-sustainable) economic system more clearly, and liberated me to begin exploring the ways we can reclaim and revitalize value creation over mere value extraction.

Lasky

Kurt, Reset began as a Time magazine essay. What gave rise to this more forgiving representation of the centralized institutions, both corporate and political, that govern us?

Kurt Andersen

Actually, the ideas in Reset germinated six or seven years ago, when I was deep into historical research for Heyday, my most recent novel, which is set in the mid-19th century. Through that research and writing, I acquired a new gut understanding of what I take to be the cyclical course of American economic and political history, and of the concomitant bipolar nature of the American character — that is, how America has always swung back and forth between Yankee prudence and manic magical thinking, between free-market worship and communitarian public-spiritedness, between financially driven busts and bubbly booms. Sometimes the cyclical swings are swift and extreme, and those violent swings can result in progressive political and economic rejiggerings of the system. So when the crash came last fall, followed by (and probably causing) the election of Barack Obama, I was inclined to take a longer view, and see it as a rare and potentially positive convergence of cyclical economic and political swings. And that led me to write Reset.

So I’m more “forgiving” of brutal bottom-line thinking and money madness than Doug, I guess, almost the way that I’m forgiving of extreme weather and earthquakes—that is, I see the age of excess just ended as the latest iteration of a periodic cycle that appears again and again in our political economy, anomalous only in terms of its exceptional 25-year-long length. I tend to agree with Doug’s major premises, such as the unsustainability of an economy dominated by financial speculators instead of “value creators,” and the fact that the particulars of our system are the result of human choices rather than immutable “conditions of nature." And I see the gobsmacking crash and resulting flux as a rare limited-time-only opportunity to significantly update and reform the system and the habits of mind that are its cause and effect. Thus we now have a chance to remake our medical and energy and educational and urban planning systems along vastly more sensible lines. But for all my hopefulness about the possibilities of change — and my desire in some ways for radical reform — as a practical matter I do take as a given our basic market-driven political economy. The decline of manufacturing and the hypertrophied financial and marketing sectors notwithstanding, Doug's assertion that "very few American businesses actually [do] anything, anymore" seems extreme to me. And I’m afraid I don’t quite get how the concern of his speak-no-evil Park Slope neighbors for their property values, no matter how cravenly expressed, is especially new or "corporate."

Lasky

Let’s talk about the temporal aspects of your books. Kurt, isn’t the divided personality you describe, and the resulting cycles of exuberance and prudence, a cause for pessimism rather than optimism? As you point out in Reset, it took only 25 years for America to fully shake off the reluctance of using aggressive military power overseas (the “Vietnam Syndrome”) and invade Iraq. It didn’t even require a generation to die out and a new one to come of age. Given our fugitive national values and convictions, how can we hope to undertake the long, hard work of reinventing our institutions, an effort that will have to involve some tinkering and readjustment over time to get it right?

Doug, at the end of Life Inc. you also refer to “the speculative economy’s cyclical nature,” but the book mostly traces a long, steady decline. One gets the sense of a golden age tarnished by centuries of greedy power brokers. You laud the early Middle Ages for its widespread wealth, leisure and educational opportunities, thanks to the use of multiple currencies. Was that period, in your view, civilization’s high point? Would you have us return to any part of it?

Rushkoff

I'm not writing about the long slow decline of the economy so much as the way our choice of economy has worked to slowly, steadily claim pretty much everything in its path. Even in the best, most optimistic "cyclical" view, the expansion and decline of the economy (and the shift of wealth between its various sectors) seems to be occurring right alongside a steady decline of something else.

I do agree that there's an ebb and flow: the economy grows and as it does, it slowly replaces our social interactions with market interactions. So things people might do together or as parts of communities become things that people do apart, and through corporate-mediated exchanges. And then, somehow, the corporations collapse and people start doing stuff with and for each other again, or retaining a bit more of the value they create. Then corporations retool, make this person-to-person economic activity illegal (or unsustainable) and reclaim commerce for themselves.

So during the Great Depression, people did start interacting and transacting again; local currencies were established. But the successful ones were eventually folded back into the regular banking system (by force) in order to stimulate the greater economy.

While there are cycles, or undulations, each of the populist uprisings Kurt's mentioning really only occur during profound recessions or depressions. They are corrections, not full pendulum swings. Laws are rarely changed to shrink corporate power or diminish the influence of speculative investment over the real economy. By the time the correction is over, we are "worse" off than we were before, at least in terms of the comparative influence of real people on their own economy.

So while I see the pendulum swinging, I see the whole thing moving in a particular direction, as well.

I don't see a golden age tarnished by centuries of evil power brokers. I see a very particular moment in history when feudalism was defended through law rather than just weapons. The late Middle Ages had its problems, for sure, but it also represented the rise of a multi-tiered system of commerce. People could use local currencies and local businesses for immediate, local needs; and they could use long-distance currencies and distant businesses for needs that couldn't be addressed locally. There was more than one economic tool for each economic job.

And this did lead to tremendous bottom-up wealth and economic activity. By some metrics, people lived better than we do: they were taller, ate more meals, invested more in R&D as a percent of GDP, did more preventative maintenance on their equipment and had tremendous surpluses of wealth — so much so that they built cathedrals. (This is not to say that we need to return to gothic architecture or a late medieval diet; just that there was tremendous wealth and a huge population increase.)

Of course, all this bottom-up wealth and the emergence of a middle class were at the relative expense of feudal lords and proto-kings, who hadn't actually created value in centuries. They simply extracted value from others. The development of centralized coin of the realm and of chartered monopoly corporations were — and I've documented all this — quite specifically geared toward giving these failing monarchs (the dying aristocracy) a way to make money by having money.

In the process, though, they made local currencies illegal. They made it illegal for colonists and locals to make clothes out of the cotton they grew. (The poverty that resulted from these changes, the new requirement to travel to a city to work for a company, the inability to do subsistence farming, are what led directly to the plague — just 30 years after local currencies were outlawed in France.) And while these laws aren't quite as explicit in most cases today, the bias of the economy developed by those few folks is still with us today. The very architecture of the economy is tilted away from the kinds of populist economic activity we all favor during these shifts of the pendulum.

So it's not some long chain of evil people. It's just a series of rules — a program, if you will — put in place a few centuries ago that almost no one seems willing to question, or even explore. We accept the rules of the economy as if they were rules of nature. The people we might like to think of as evil are simply unconscious. They really don't see the economy as open source in the least. They're just using Windows 3.1 as if it's the only OS in town.

The reason I'm not as forgiving as Kurt, I suppose, is that I don't see these cycles as weather or earthquakes. I see them as entirely predictable manifestations of the system we've adopted. People think they need cars because "how else would I get to work?" without understanding that they only need a car to get to work because the suburbs were zoned, in part, to promote car ownership (or, in most cases, promote real estate speculation). So we look at Europeans and think how lovely it is they get to walk home for lunch, and assume something about America's geography made this impossible. Does this mean we can get rid of the car suburbs? Probably not. At least not in the short term.

And neither do we just retire the Fed and crash the banks. We can't go back to the Middle Ages, and we don't want to.

What we can do is promote the development of complementary economic mechanisms. New ways (and old ways) of doing commerce. Things as simple as Community Supported Agriculture, where people subscribe to a local farm instead of just buying Big Agra produce from the supermarket. It's not that local farming is genuinely less efficient; it's that it has been rendered less efficient by a marketplace developed by and for agricultural conglomerates. No conspiracy required. Just another one of those biases built in to an economy based on centralized currency and centralized banking, or where corporate lobbies can argue for the interests of large entities more effectively than local constituencies can argue for their own.

That's why I am in full agreement with Kurt when he explains: “I see the gobsmacking crash and resulting flux as a rare limited-time-only opportunity to significantly update and reform the system and the habits of mind that are its cause and effect. Thus we now have a chance to remake our medical and energy and educational and urban planning systems along vastly more sensible lines.”

This is the goal. And some of it really does need to be accomplished using large, centralized agencies or businesses. National healthcare, energy....

But, when Kurt adds: “For all my hopefulness about the possibilities of change — and my desire in some ways for radical reform — as a practical matter I do take as a given our basic market-driven political economy,” I'd have to counter that the basic market-driven political economy in which we are living can be slowly improved as we introduce alternative methods of investment and transaction.

The local organic restaurant in my town was unable to complete its renovation because the bank it had been dealing with froze its lending. So the owner turned to the community, instead. We each invested what money we had to spare, and received credit to spend at the restaurant. Every 100 dollars invested got us credit for 120 dollars of food. He got the money he needed cheaper than he could get it through the bank, and we got 20 percent return on our investment.

Plus, instead of simply outsourcing our investment to unknown companies doing unknown things, we invested in the fabric of our own community — making it a better place to live, attracting more business, and so on.

As people do more of this — if people do more of this — the political economy that we're talking about will necessarily be drained of its overwhelming power. It doesn't have to go away at all; it's just that it should be funding oil rigs and fighter jets — not local restaurants, at exorbitant interest rates that ultimately favor Wal-Mart over mom and pop.

And as people source food through alternative means, and consider working locally instead of commuting to corporate jobs, then the economy that has been based on highly centralized industries like oil and agra ends up being fundamentally changed. So I'm not talking about creating some kind of movement where we upend the market economy. Just lots of activity outside it.

Andersen

I agree with most of what Doug has just said — especially his New Urbanist critique of the wasteful, community-busting, car-centric real estate development paradigm that has dominated since World War II. I'm all for encouraging alternative methods of investment and transaction, whether Community Supported Agriculture or organic food patrons becoming micro-investors in their beloved local organic restaurant.

But I would point out that in a more or less free market economy, even if large businesses do sometimes strive to "make...person-to person-to-person economic activity illegal (or unsustainable)," they're seldom able to do so altogether. Yesterday, for instance, I undertook three main economic transactions: I took clothes to an individually owned laundry a few blocks away, called in a guy from a five-person tech-maintenance firm to fix my Wi-Fi system and had dinner with old friends at a 30-year-old stand-alone restaurant. And, of course, the internet has enabled vast amounts of person-to-person economic activity, some of it mediated by large corporate entities (such as eBay) and a lot of it not (craigslist, Alibris), and a lot of it not really economic at all (such as Change Observer and our present discussion). And on the other hand I've got to say that not all corporate attempts to reclaim commerce for themselves seem sinister to me: for instance, the legal fight by the recording industry against file-sharing has been ham-fisted, for sure, but as a creator of intellectual property I'm sympathetic. Also, Doug may not think the 1930s or 1960s represented full pendulum swings, but they (and the swing of the last 25 years) were plenty full enough for me. Concerning the globalizing spread of large-scale, corporate-dominated market systems, I would point out the hundreds of millions of people — especially Chinese people — it has lifted out of wretched poverty during the last few decades.

As for the strongly two-sided nature of the American character and the (related, though not necessarily "resulting") cyclical nature of the American economy and zeitgeist, I think it's perfectly plausible to see it as either a glass half-full or half-empty. But because I do take those bipolarities as givens and I am more optimistic than not, to me the task of right-thinking Americans is to moderate and mitigate the waste and pain produced at the extremes of the cycles, and to use the periodic systemic seizures as opportunities to clear out the decadent and dysfunctional bits and adjust and improve the particulars of the system. I do think our size and power as a nation for the last century has made this all more problematic on the global military front — you don't really want a superpower swinging between bipolar extremes. I think we over-corrected after Vietnam, and then over-corrected for that over-correction (from the invasion of Grenada to the invasion of Iraq), and one of the reasons I'm hopeful right now is that we seem to have learned the lessons of both extremes, and to be on an unusually sensible, sober, sustainable foreign policy path.

I do worry that Americans lack the patience to do the long, hard work of reinventing (and readjusting) institutions. The digital revolution has, for worse as well as better, reinforced our national weakness for instant solutions. On the other hand, the era just ended was so exceptionally long — a quarter century — that it seems reasonable to imagine that the chastened, more prudent era now getting underway will last long enough to let us fix the things we need to fix. "Fugitive national values and convictions" is a great phrase, but my point is that those values and convictions and temperaments have always co-existed. What we need to do is integrate them with a little more finesse, learn to embrace the paradox — as F. Scott Fitzgerald said, to hold two opposing ideas in mind at the same time and retain the ability to function.

Rushkoff

“I do worry that Americans lack the patience to do the long, hard work of reinventing (and readjusting) institutions.”

Yeah. That's what keeps me up at night, too. (And then I worry about the fungus killing all the bats, the whatever-it-is killing all the bees and the way Michael Jackson wiped Iran off Twitter.)

Google recently announced its new OS. And while (as an enemy of corporatism) I'm supposed to be upset, I find myself thrilled at the relief from consumption such a development portends. Instead of maintaining a laptop bloated with software and files, I'm actually going to get to have a netbook or net-desktop that does pretty much everything I want. (And no, I'm not scared of the massive centralization posed by a Google-served net universe any more than I am by one where we buy all of our installed software from the same couple of companies.)

So I am as thrilled as you are by the scaling down of a certain kind of consumption and production, a cultural ethos that values efficiency and a certain kind of modesty over Lincoln Navigators and McMansions.

You are right that the (rather unconsciously perpetrated) corporate-government alliance usually can't shut down things completely. But then I remember examples like the toy outsourcing scandal, where American toy corps distributed toys from China painted with lead. New regulations were developed by industry and government "working together," which now require toy manufacturers to test any toy being sold to an American child. The tests cost upwards of $50,000, and require a hundred or so units of the toy to be destroyed in the process. Because the regulation applies to all toys, it effectively puts small companies out of business. If the regulation isn't repealed by February, that's it. The mega-corporate practice leads to problems that in turn lead to regulations that favor mega-corporate practices.

Unless, of course, people find out, write letters, and demand the right kinds of changes.

I just came to feel that there are so many similar regulations in place that they no longer feel like regulations. They just feel like the way business happens. People think local currencies are impossible because there is no "oversight" or "checks and balances," failing to realize that babysitting clubs may not benefit from federal oversight, or that if someone lies about having put in an extra hour of babysitting, it might not crash the whole system.

And the other biggie I'm looking at now is whether there are ways for us to feel comfortable transacting, even if the things we are exchanging are in abundance. I understand how we make markets for scarce things, and why we (or central banks and monarchs) made money artificially scarce.

What I don't yet fully grasp is how our economy will be able to tolerate things in abundance. And this seems a pity. If we really could get everything we absolutely need with everyone working just a day or two a week, how would we cope? The fact that this possibility isn't acceptable by our current economy means to me that some adjustment is in order – or at least some head-scratching.

Andersen

Totally agree with you about Google. In fact, it's an excellent example of how the last 15 years have been the best of times as well as the worst of times: Google versus Microsoft is real competition producing real progress, and in fact I trust Google with my precious data (such as Google Docs) more than I would a small, non-"corporate" entity. And your example of misguided corporate-scale regulation in the toy industry is a perfect illustration of why progressives need to forge a regulatory Third Way.

I must say I find your fondness for the idea of local currencies rather quixotic. Until I did my research for Heyday I hadn't really known about America's experiment in the mid-19th century with local paper currencies — issued by 1,600 local banks in 30,000 varieties. That didn't work out too well. And the occasional utopian schemes involving local currency — such as Josiah Warren's “labor notes” used in the 1840s in the Ohio River Valley — never managed to catch on either. As soon as railroads and the telegraph arrived, national coherence demanded national currency (and national time zones and a zillion other national rules of the road).

Central banks make money artificially scarce? Yes, but not only scarce — and certainly not our central bank right now, for instance. Isn't it more like a carburetor that makes fuel, second by second, "artificially" scarce and plentiful?

Your final, larger question — coping with superabundance and cultivating habits other than pedal-to-the-metal revenue maximization as individuals and enterprises — is indeed a vexing one. But to the degree more and more people these days are eagerly lavishing time and energy on financially non-remunerative activities and enterprises — the web, as you know, is as much or more about a renaissance of the amateur spirit as it is about large-scale corporate commerce — I'm heartened.